HSBC

Global Money

Large banks are in a competition for the next generation customer, who focus on price and features with the best app experience winning.

What is global money?

Global money was HSBC's answer to free international transfers from smaller digital banks, an account where you can hold and send money in multiple currencies.

Starting point

I arrived in the global money team a little late for party because the core journey had already been worked on. From what I could see the core journey was based on the international payments journey which luckily I had worked on the previous year.

We used the core journey as a baseline and then changed what was needed for the needs of the country being designed for as each country has its own banking culture and regulations. Plus the stakeholders their own priorities on how many features to take to work with budgets.

No fee international transfers

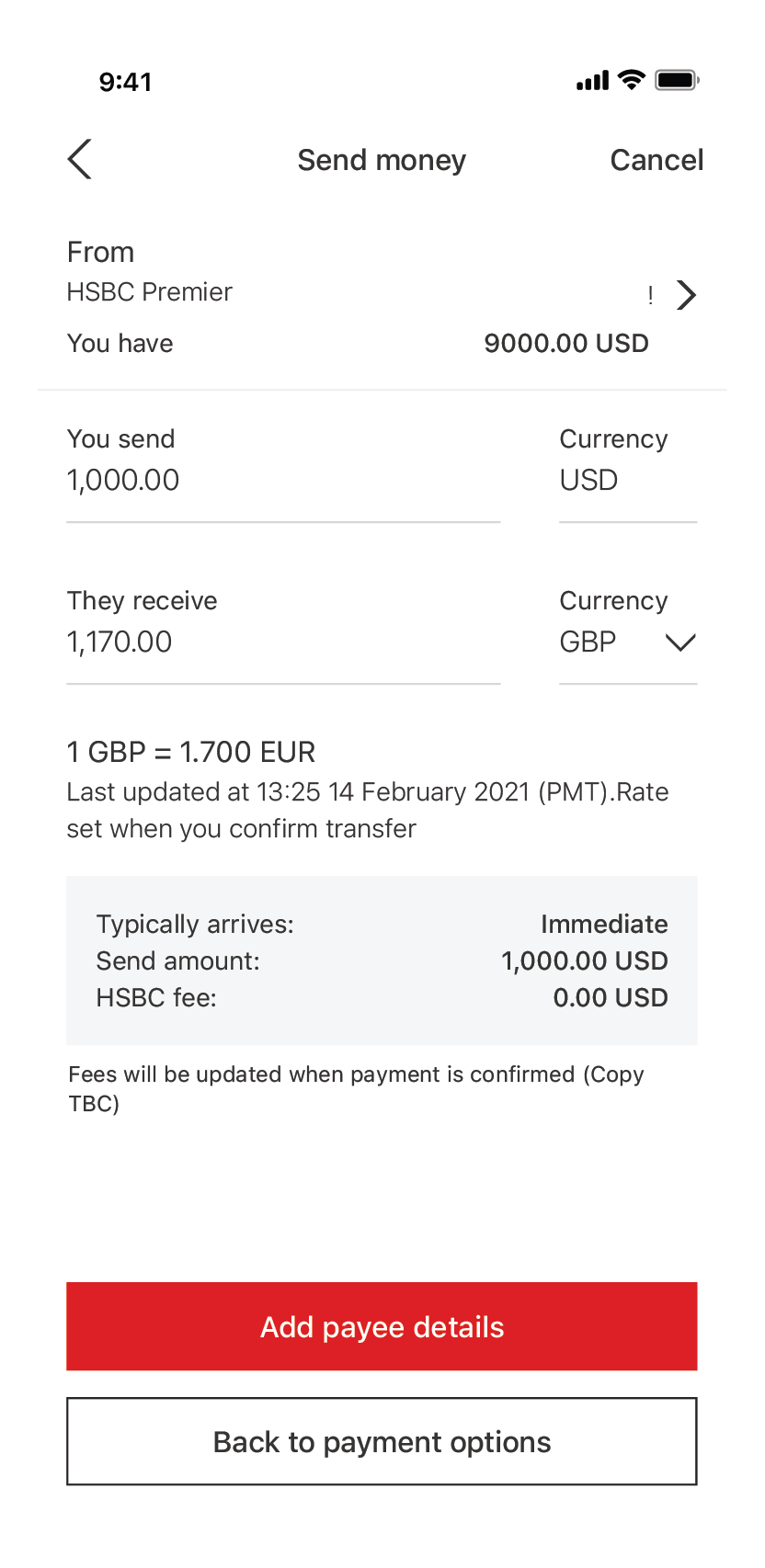

HSBC's global reach allowed them to utilise their already established network using a branch to branch transfer system to send overseas and then from there an internal transfer to the person.

HSBC could pass these benefits to customers in the form of free transfers. Where there was a third party transfer fee in most cases the bank would cover the fee and the use best exchange rates possible.

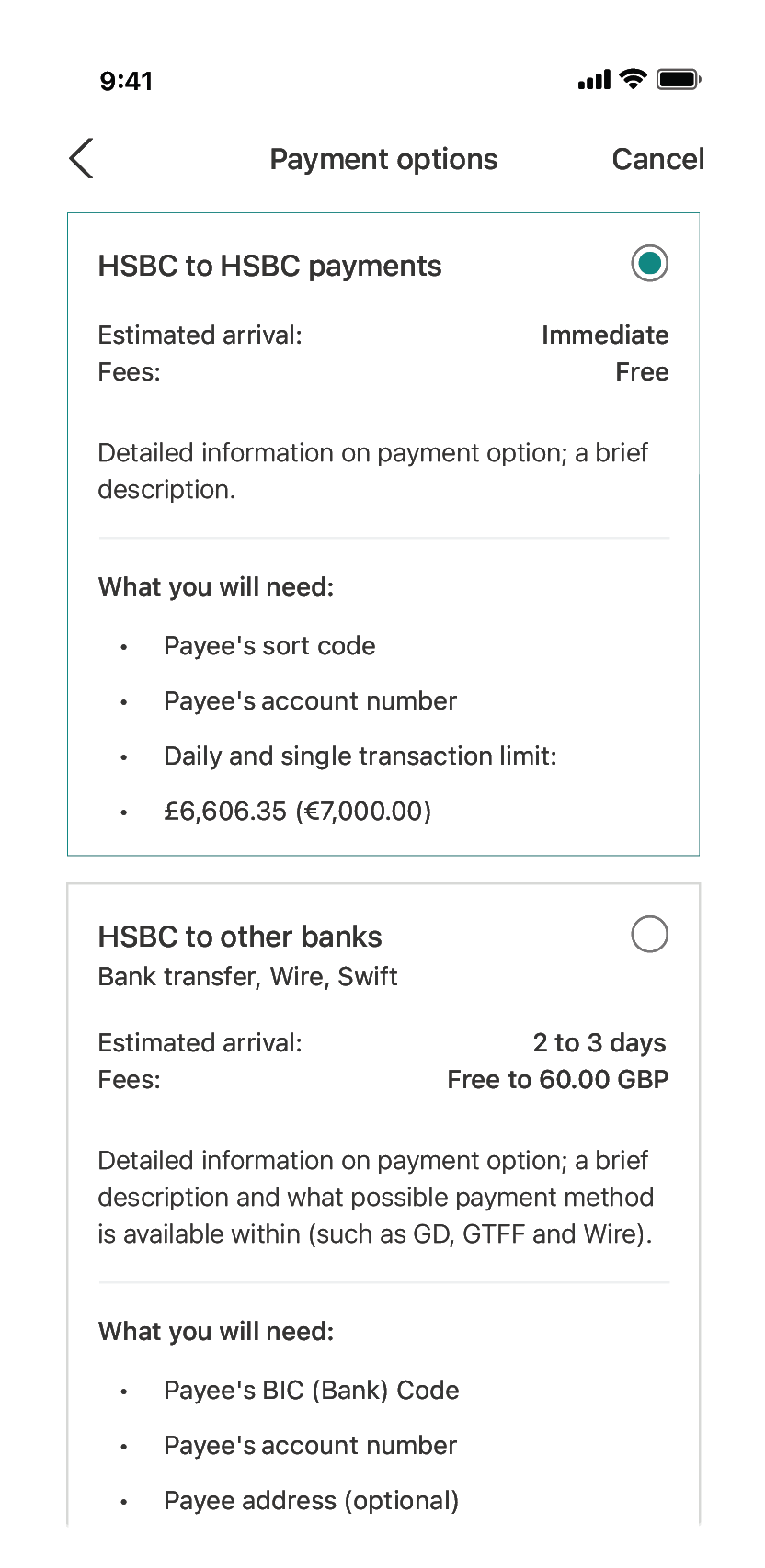

HSBC does not have a presence in every single country in the world so to get past that they would automatically defer the payment onto one of a few different ‘payment rails the fastest and cheapest rail would be chosen which the bank would cover the cost of in most cases. Sometimes the receiving bank would charge a fee.

Complex solution

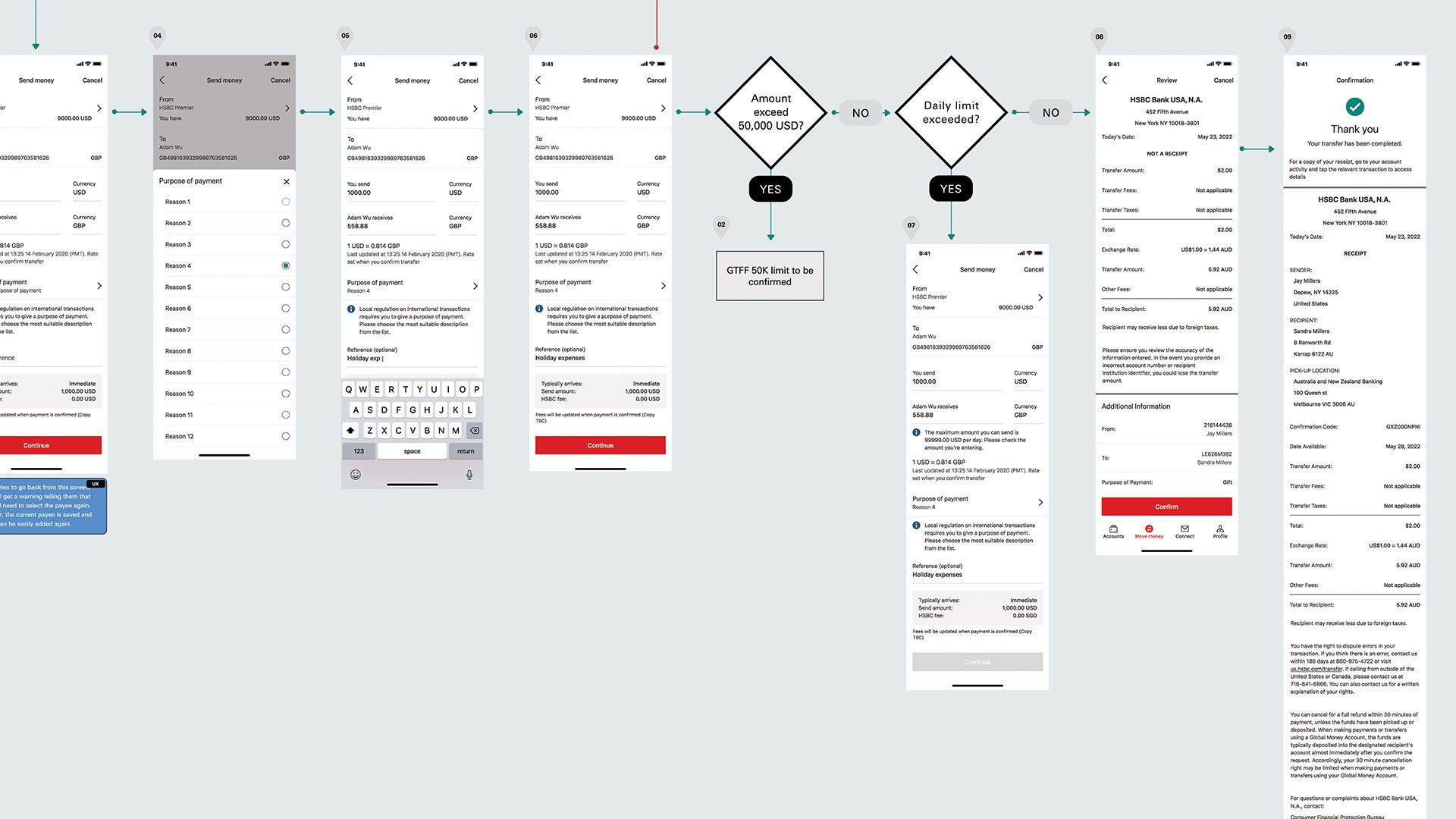

In most cases with the UX it meant there were complex UX documents and the final result was that the payment rails are selected automatically rather than have the customer do that up front. There was also a new financial contact library incorporated into the journey for the first time for the bank so that customers could find the person to pay quickly and easily.

Making Global Money Global

I got to work rolling out to the following markets

Expat (Brits Abroad)

United Kingdom

United States

Canada

Brits abroad

Expat was the first country I worked on, it was the journey for all UK foreign nationalists living abroad in any other country. The bank servicing the transfers was located in Jersey. The sheer numbers of UK nationalists living abroad made this a core market.

Adding features

The core journey had been worked on at pace and so some tidying up was needed and the ux with each iteration we improved the flow. Some countries needed additional features and used or did not use combinations of ‘payment rails’ (technical methods of transferring the money) which meant slightly different flows.

Other added features were purpose of payment questions, more detailed payment receipts, fraud alert messages and the financial contract library, this was a new way for customers to add and manage contacts to be payed.

Showing fraud warning

75

Net promotor score

for UK journey

World class experience

4

Account openings every 60 seconds

Strong launch performance

70%

Customers new to international payments

Brand new revenue

Learnings

A new product launch is exciting, first time my work has been supported by a TV advertisement which was cool to see. I learnt a lot about doing more formal and secure UX. The UX team I worked with on this project was exceptional and lead by Greg Norman who I reccomend checking out as he has recently gone into contracting.